On September 16, 2024, State Superintendent Chris Reykdal published an Education Funding budget proposal stating that “Washington currently underfunds K–12 education by around $4 billion per year.” He then requested an additional $2 billion per year to reduce this school funding gap. So while claiming our schools are under funded by $4 billion, he is asking for $2 billion – with the other $2 billion apparently to come later after he is re-elected. To get this additional $2 to $4 billion per year, Reykdal wants to impose a State Income tax – a plan which is doomed to fail because it has been voted down many times in the past (and is likely against our state constitution).

Since the Reykdal proposal, there have been more than a dozen articles published by experts all over the state about how we can fix our school funding problem. Some claimed we need to remove the levy lid so that voters in wealthy school districts can fund their local schools. This claim ignores Article 9, Section 2 of our State Constitution which requires a “uniform” system of public schools. Our state is therefore not allowed to have wealthy school districts that can pass levies and poor school districts that can not pass levies. Other experts claim we should just cut $4 billion in funding for other state services to pay for schools. This would raise school spending up to 50% of the total budget. While there is serious bloat in our state government, it is unlikely that $4 billion in cuts can or will be found. In fact, it is unlikely that even $1 billion in cuts can or will be found.

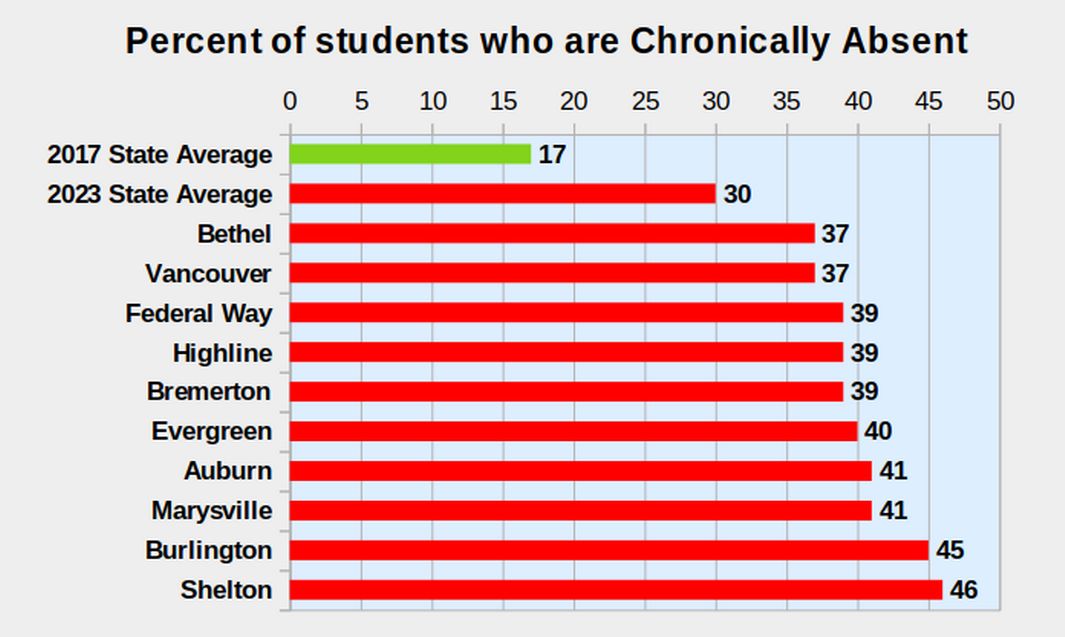

On September 26, 2024, Seattle City Club hosted a debate between Chris Reykdal and his challenger David Olson. Both candidates were repeatedly asking during the debate what they will do to fix the school funding problem if the legislature fails to comply with their Constitutionally duty to fully fund our schools. Reykdal claimed that he was confident the legislature would provide the needed revenue. David Olson said he would ask our Supreme Court to intercede. Unfortunately, we already tried going to our Supreme Court from 2007 to 2018. All we got was the current McCleary school funding mess which jacked up taxes in King and Snohomish Counties by 60% in past 6 years without any real increase in school funding. Teachers are still being fired. Class sizes continue to go up. Schools are being closed and the Student Absentee rate has skyrocketed from 15% to 30%.

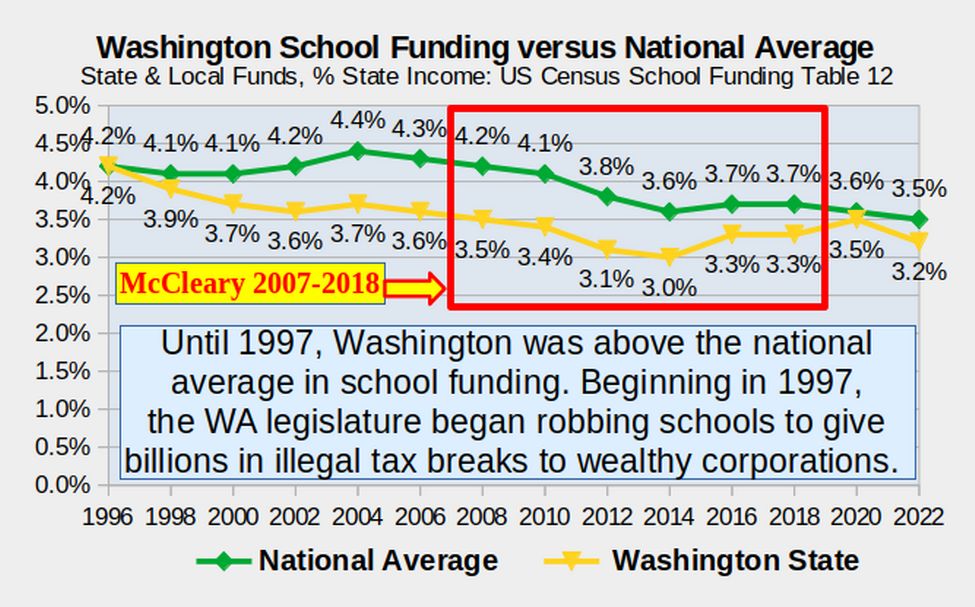

Student Achievement is at an all time low and the Opportunity Gap is at an All Time high. Here is a chart of Washington School Funding since 1996 with the McCleary case in the red box from 2007 to 2018:

Source: https://www.census.gov/programs-surveys/school-finances/data/tables.html

You can see that Washington state school funding has been 10% or more below the national average since 2000 with the exception of 2020. Near the right side of the above table (2020), it appears that Washington state school funding came close to national average. This was a one year outlier due to the fact that the McCleary Fix Levy Swipe had a double taxation year in 2018 in which both the new State Levy and the old Local Levy rates applied. We are currently back down to 3.2% of State Income which is where we were in 2011 – with the only difference being that homeowners are now paying much higher property taxes.

We cannot solve the school funding problem by re-electing the same people who caused the school funding problem in the first place. It is time to finally look at and fix the underlying problems that caused this mess 24 years ago and advocate for real solutions that permanently fix these underlying problems. That is the goal of this report.

Why Percent of State Income is the Best Way to compare School Funding to other states and over time

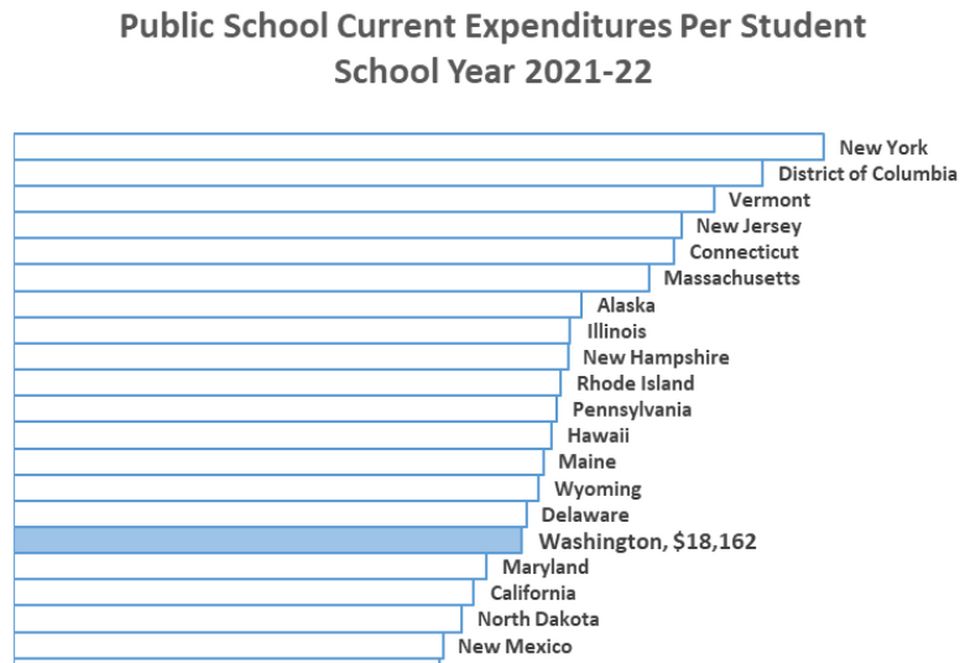

It is common for opponents of school funding to focus on Per Pupil Funding. But Per Pupil funding does not account for the huge Cost of Living difference between wealthy states like Washington and poorer states in the south and midwest. In addition, Per Pupil funding does not adjust for inflation which causes the price of everything from books to buses to go up over time. Currently, only Hawaii, California, Massachusetts, New York and Alaska have a higher cost of living than Washington. The best way to account for Cost of Living and Inflation is by using Percent of State Income.

Washington School Funding compared to the rest of the nation

Washington State has 2,300 schools with 1.1 million students and currently spends $30.6 billion dollars per biennium ($15.3 billion per year) on our public schools. This does not include $2.4 billion in local levy funds or $2 billion in federal funds for a grand total of $19.7 billion or $18,162 per student. This per pupil amount places Washington 16th highest in the nation in per pupil funding. Here are the Top 20 States in per pupil funding:

To achieve national average school funding as a percent of income, Washington would need to add about $2 billion per year which would put Per Pupil funding up to about $20,000 per year (just below Massachusetts). This would put Washington at 3.5% of State Income.

Washington Teacher Pay compared to the rest of the nation

According to the National Education Association, Washington is now fourth highest in the nation in average Teacher Salary at nearly $87,000 per year. Source: https://www.nea.org/resource-library/educator-pay-and-student-spending-how-does-your-state-rank/teacher

Currently, in the Seattle School District, first year teachers with a Bachelor’s Degree start at $72,000 per year with the most senior teachers making $141,000 per year. Below are the Top 9 States in Teacher Salaries

We will review the history of changes in teacher salaries in a later section. The question we need to address is what happened 24 years ago that caused school funding to fall so far below the national average 24 years ago?

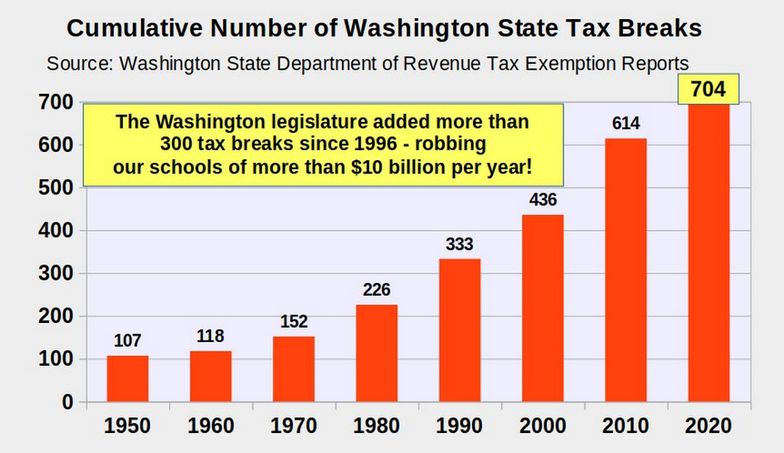

The answer which we will also take a closer look at in a later section is that 24 years ago, our legislature began robbing school funding in order to give billions of dollars in tax breaks to wealthy corporations like Microsoft and Boeing. Until this robbery is ended, we will not solve the school funding crisis. Here are just some of the symptoms that are occuring as a result of this school funding robbery:

Symptoms of our broken school funding model…

Symptom #1 Firing Teachers

More than 1,000 teachers were fired from schools all across Washington state in May 2023 – and another thousand were fired in May 2024 – and another thousand will be fired in May 2025 and May 2026 - due to our broken and corrupt “McCleary” school funding model. Parents have been left in the dark regarding the real reasons of why this is happening – and why these teacher firings will continue to happen every May until we organize to address the underlying causes of this problem.

Symptom #2 Closing Schools

In May 2024, the Seattle School Board announced that they will be closing 20 of their 100 schools – with all 20 being local elementary schools. The reason given for these 20 school closures is that the Seattle School District is facing a budget shortfall of over $100 million – a shortfall which is likely to rise to $130 million in May 2025 and over $150 million in May 2026. Closing a school results in a savings of about $1 million. Thus, closing 20 schools would still result in a budget shortfall of $80 million.

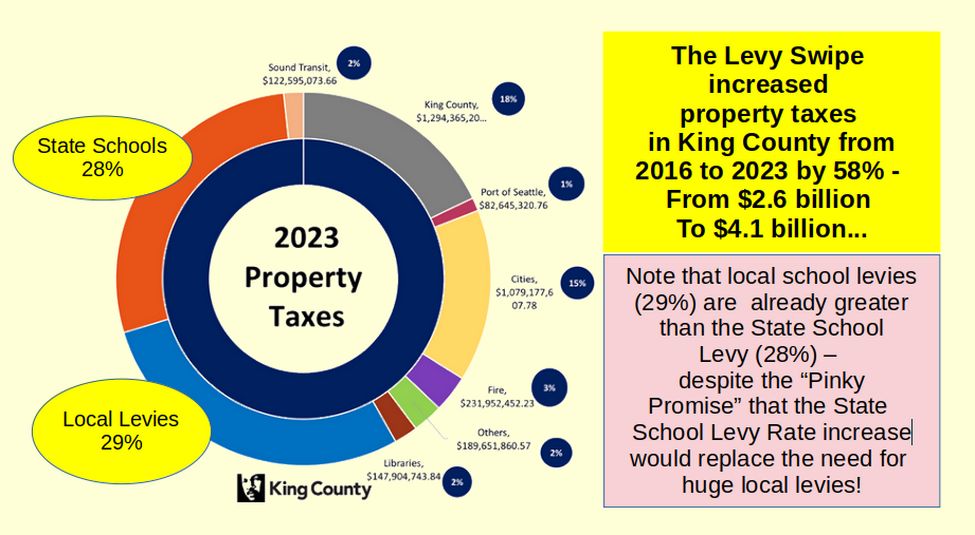

Symtom #3 Skyrocketing Property Taxes

Property taxes on more than one million families in King County have risen by thousands of dollars a year (more than 60%) in just the past 6 years since the McCleary Fix:

Symptom #4: School Funding does not account for skyrocketing Inflation

Since 2021, there has been skyrocketing inflation. Part of this is due to national policies which have increased the cost of everything from books to food by about 40%. Another part of it has been bills passed by the Washington state legislature that has increased the cost of fuel by 40%, the cost of natural gas by 76% and the cost of insurance by 60%. Meanwhile, the average teacher salary has risen 20 to 30%.

The underlying problem for our school funding crisis is not merely the billions in tax breaks for Microsoft and Boeing. The real problem is that our current state government is extremely corrupt! To understand how corrupt our state legislature really is, we need to go back to June 30, 2017 when our state legislature passed House Bill 2242 – also known as the McCleary Levy Swap – or more accurately known as the McCleary Levy Swipe.

House Bill 2242 was directly responsible for raising our property taxes by a billion dollars a year – while at the same time, setting into motion a very real decline in school funding.

Understanding the McCleary Levy Swipe: A Crime against our Kids

On June 30, 2017, a horrible crime was committed in Olympia, Washington. It was a crime not only against one million children who attend our public schools, and a crime against more than two million homeowners in King and Snohomish counties, but also a crime against several sections of our Washington State Constitution. To understand this crime, we need to go back to the crime scene and re-enact this monstrous theft – a theft I call the McCleary Levy Swipe. This crime actually began in the 1990’s. This was the last time Washington state was above the national average in school funding as a Percent of State Income.

Washington State used to be 10th in the nation in school funding

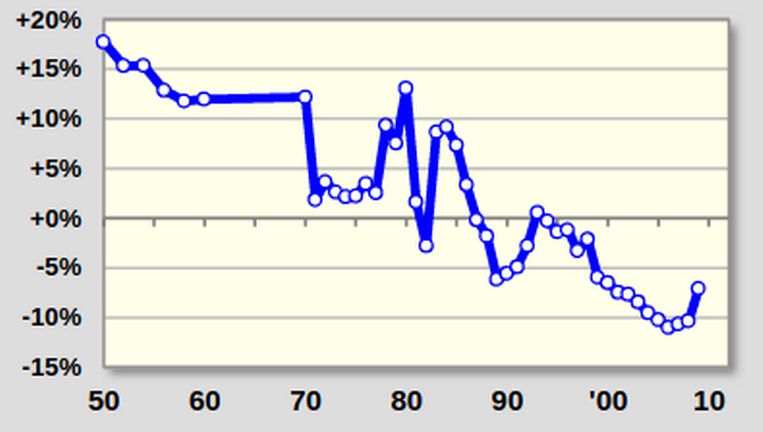

Historically, national average school funding has been about 4% of Total State Income. Since 2014, national average school funding has fallen to 3.5% of Total State Income. Since 2000, Washington state school funding has been about 10% below national average school funding which is why our class sizes have been about 10% above the national average. However, until 1997, Washington state school funding was actually at or above the national average. Here is a historical chart going back to 1950:

1950 to 2009 Ratio of Per-Pupil Funding: WA divided by US AVE

https://www.wsipp.wa.gov/ReportFile/1108/Wsipp_K-12-Education-Spending-and-Student-Outcomes-A-Review-of-the-Evidence_Full-Report.pdf

In the 1980’s, Washington state was 10th in the nation in school funding as a percent of state income. However, beginning in 1997, the Washington state legislature began granting billions of dollars in tax breaks to trillion dollar corporations like Microsoft. These huge tax breaks were and still are against several sections of our Washington State Constitution. But ever since 1997, our state has fallen below the national average in school funding, despite increasing the state tax burden on local homeowners and small business owners.

Currently, there are more than 700 of these illegal tax breaks totaling more than $30 billion per year. We will never be able to address the school funding problems in Washington state until these illegal tax breaks are removed. This will not harm Microsoft or other corporations as they can easily deduct their state taxes from their federal taxes.

The McCleary School Funding Scam actually began in 2011

The McCleary lawsuit claimed that the State failed to comply with Article 9, Section 1 which requires the State to provide “ample funding” for the education of all children in Washington state. Trial Court issued its ruling in 2010 meaning that the 2011 legislature needed to supply adequate funding in 2011 – which it could have easily done in 2011 simply by repealing a few of the 700 illegal tax breaks.

However, instead, the legislature came up with a convoluted “Prototypical School Model” plan which they “Pinky Promised” to fund in order to comply with the State Constitution by 2017. Sadly, in 2012 our Supreme Court ignored the trial court ruling and gave the legislature until 2017 to comply with their Paramount Duty to amply fund our schools. Imagine getting caught robbing the bank and then telling the court you are sorry and will stop robbing the bank in 2017. The Supreme Court and the legislature essentially both turned their backs on an entire generation of children.

Back to the 2017 Crime Scene

Naturally, the legislature did next to nothing to increase actual school funding between 2012 to 2017. What they did instead was grant the largest tax break in state history to Boeing. Which brings us back to June 30, 2017. A vote was called on House Bill 2242 – a last minute 120 page bill that was only published the day before.

The bill called for a billion dollars in new State property taxes – the largest tax increase in State history. But at the same time, the property tax increase would actually occur when homeowners passed new local levies to replace the billion dollars in local levies that were robbed and placed in the state general fund account.

The bill promoters falsely claimed it would provide enough revenue to restore teacher pay to what it had been 20 years earlier – when in fact it did not provide any additional funding for our schools. Instead, it protected billions in tax breaks for wealthy corporations.

A few Senators, who were friends of mine, emailed me this bill at 10 pm on June 29th and asked me to analyze it. I stayed up all night and the next morning I reported to them that this bill was a Ticking Time Bomb. I explained that it would cause a record property tax increase of billions of dollars on homeowners in King and Snohomish Counties just to protect billions of dollars in tax breaks for some of the richest corporations in the history of the world. I also warned that it would not actually increase school funding but instead would lead to the mass firing of thousands of teachers and eventual closures of hundreds of schools all across Washington state. These Senators then emailed my report to every member of our Legislature that same morning.

Pretend for a moment you are in the Legislature and it is your turn to vote on this Levy Swipe bill. Would you vote for a bill that forced a record tax increase on millions of homeowners - and the eventual firing of thousands of teachers – all to protect billions in illegal tax breaks for the richest corporations in the world?

Neither would I.

But despite being clearly against several sections of our State Constitution, House Bill 2242 was supported not only by a majority in the State Legislature, it was also supported by the State Superintendent, Chris Reykdal and the Governor, Jay Inslee, and also the State Attorney General, Bob Ferguson. Inslee signed the bill, calling it a historic moment.

Bob Ferguson wrote a brief misleading our State Supreme Court into believing that the bill would actually provide “ample funding” for our schools. The Supreme Court basically took Ferguson’s word – ending the 10 year McCleary school funding battle.

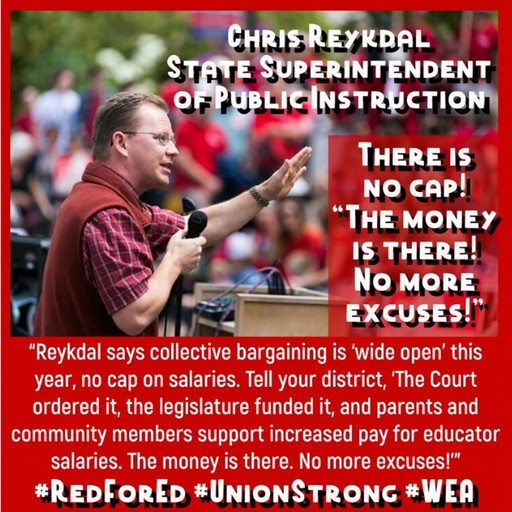

In 2018, Chris Reykdal (with the cooperation of the teachers union) misled teachers into believing that the Levy Swipe would result in billions of dollars in additional school funding. His blatant disregard for the truth led teachers to demand billions of dollars in pay raises as high as 20%.

The unfunded teacher pay raises meant that eventually thousands of teachers would have to be fired and hundreds of schools closed in order for school districts to balance their budgets.

To be clear, I am not saying that teachers did not deserve a pay raise. I am simply saying that Reykdal misled them by claiming that there was a huge amount of money available from the Levy Swipe bill – when in fact there was no money available.

So if you are looking for someone to blame for the fact that 20 elementary schools are being closed in Seattle while your property taxes are going through the roof, look no further than Chris Reykdal. Or alternately, look no further than Bob Ferguson for misleading our Supreme Court. Or alternately, look no further than our State legislature which passed the Levy Swipe bill in order to protect billions in tax breaks for wealthy corporations like Microsoft.

A School Funding Roller Coaster Ride during the past 7 years

In 2017, the Washington Legislature passed the McCleary Levy Swipe – robbing school districts of $1 billion in Local Levy funds and magically converting it into $1 billion in State funds. I warned at the time that the Levy Swipe would create a “ticking time bomb” that only temporarily increased school funding. I predicted that, in the long run, the Levy Swipe would lead to a Double Whammy of both huge property tax increases (the largest tax increase in state history) and the eventual firing of thousands of teachers.

Legislators who voted for the 2017 Levy Swipe claim that state support for school funding increased from $8000 per pupil in 2016 to $12,000 per pupil in 2022. But they ignore several important facts. First, after adjusting for inflation, the increase was only from $8,000 to 9,000 per pupil (with just over one million students, this is an increase of about $1 billion). Second, this $1 billion increase was done by stealing $1 billion in local levy funds and calling them state funds. Third, when homeowners voted in new local levies, their property taxes went through the roof.

The effect of the Levy Swipe was hidden and delayed for years because the Levy Swipe began with a deceptive “double taxation” year in 2018 which left high local property taxes in place for one year while adding a record increase in state property taxes in 2018.

The Double Taxation year led to the illusion that school districts had lots of money. The double taxation year in 2018 only temporarily carried school districts through the 2019-20 school year.

How Much of an Increase in School Funding Did the Levy Swipe Actually Provide?

Here we explain why the Levy Swipe did not provide any additional funding – in fact, it reduced school funding in our State. Let’s look at a couple of charts the State gave the Supreme Court in their July 30, 2017 Report. You can read the entire State Report at this link:

http://www.courts.wa.gov/content/publicUpload/Supreme%20Court%20News/2017ReportbytheJointSelectCommittee.pdf

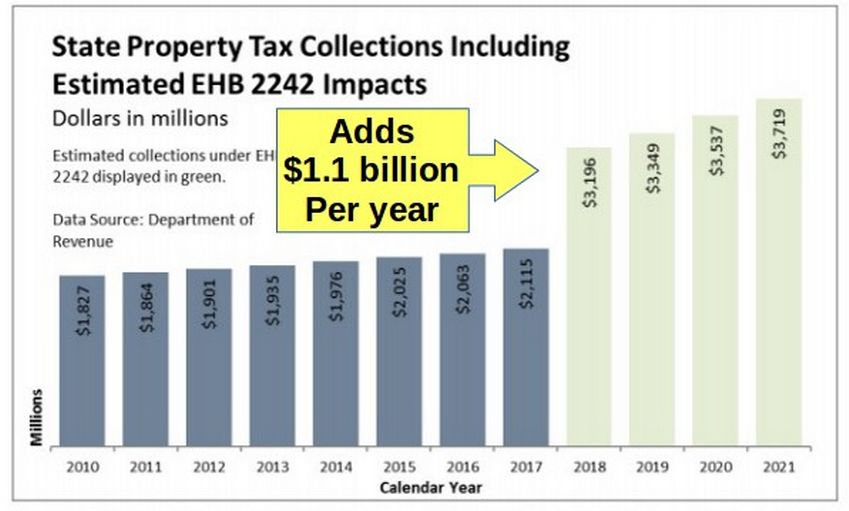

On page 50, the State claimed that the new State Levy will increase “state” property tax collections by $1.1 billion dollars per year beginning in 2018. The chart below shows actual State Levy Tax Collections for 2010 to 2017 and then estimates that these tax collections will increase by $1.1 billion in 2018 due to House Bill 2242 (aka the Levy Swipe).

Note that the new State tax starts in 2018.

To be clear, $3.2 billion in 2018 minus $2.1 billion in 2017 equals $1.1 billion dollars. So new State funding would be $1.1 billion (or as we will say throughout this report, about one billion dollars per year).

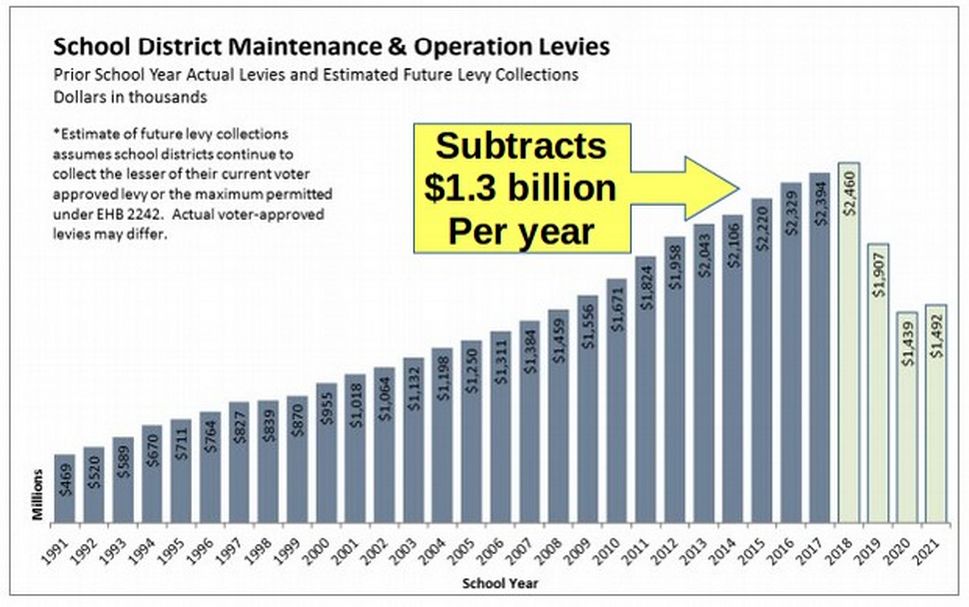

But then a different State Chart on Page 57 of their Report shows local levies going from $2.7 billion in 2020 to $1.4 billion in 2020 – a loss in local levy funds of $1.3 billion dollars per year.

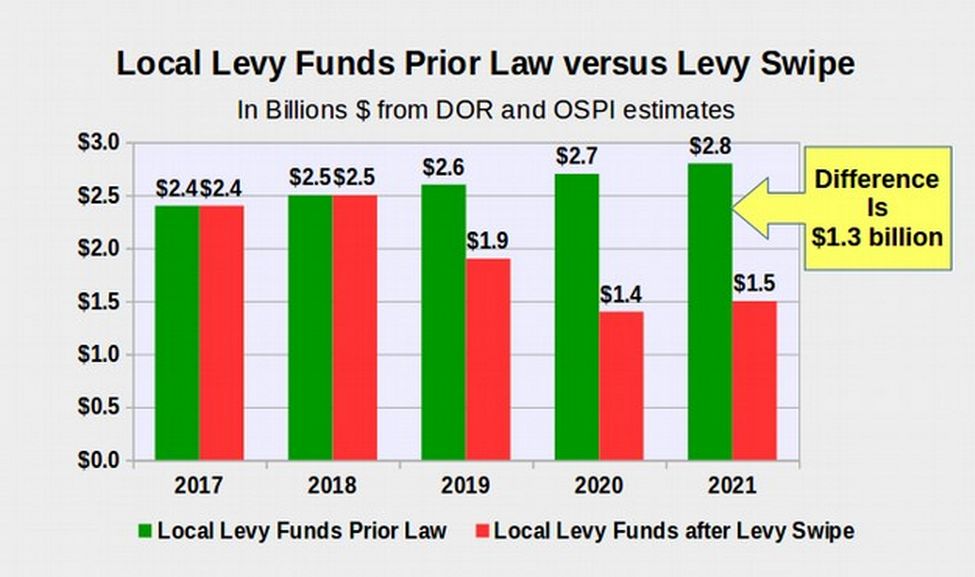

To be clear, the 2017 local levies totaled $2.4 billion and have been rising at a rate of $100 million per year. This means that by the year 2020, under the former school funding process, local levies would have been $2.7 billion. Instead, local levies are estimated to drop by $1.3 billion (from $2.7 billion to $1.4 billion). Here is a chart that more clearly shows this year by year difference in local levy funds:

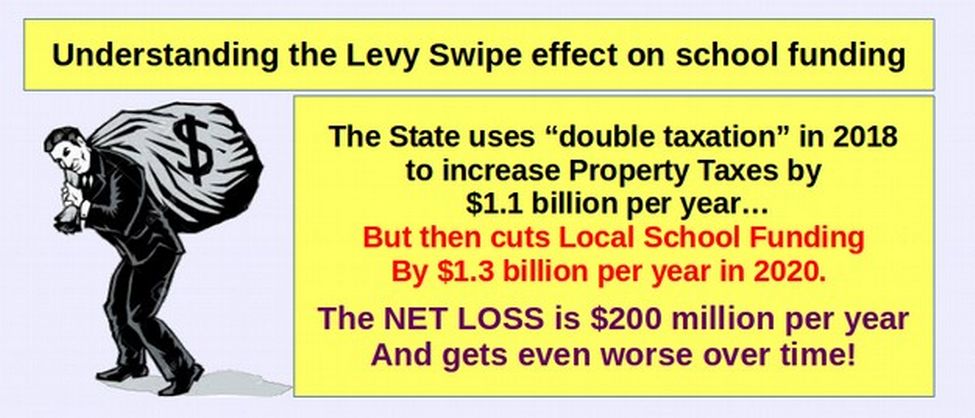

Thus, even according to the State’s own estimates in their report to the Supreme Court, the levy swipe will result in a State gain of $1.1 billion but also a local loss of $1.3 billion for a NET LOSS OF $200 million per year beginning in 2020.

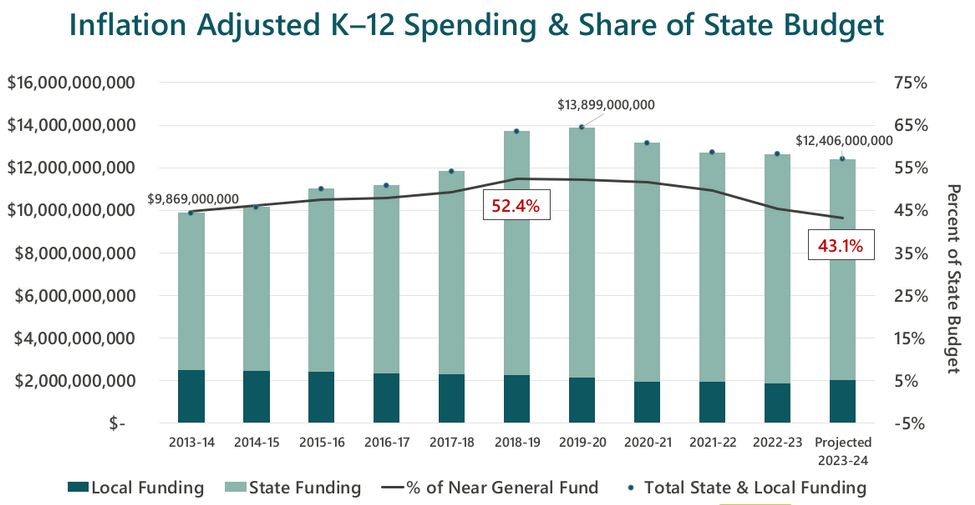

Here is another chart OSPI released in January 2024 on inflation adjusted school funding over time:

This chart implies that in 2018, there was an increase of $2 billion in State Funding (from $12 billion to $14 billion) in 2018 and 2019 due to the 2017 McCleary Fix. But note three things. First, school funding is dropping back down to $12 billion in 2024 – which is why the teachers are being fired and schools are being closed.

Second, there was no actual increase in funding in 2018 or 2019. Instead, the increase in spending those years was due entirely to about a billion dollars being “swept” from a Public Works capital construction account. This was a one time theft from local governments which forced them to raise local property taxes to fund their local public works construction projects. In addition, about one billion dollars in local levy funds, mainly from King and Snohomish counties, were moved to the State fund.

Third, the local levy funds continued to be charged during 2018 – meaning that homeowners were charged twice in 2018 – once under the old school funding system and again under the new funding system. It was the double taxation in 2018 that allowed school funding to rise to $14 billion in 2018. The surplus from the double taxation allowed school spending to remain at $14 billion in 2019.

What is also not shown on the above chart is that the old levy system ended in 2018. To add insult to injury, in 2018, homeowners were asked to pass new school levies to replace the old levy funds that had been stolen and placed in the state fund. Naturally, most parents voted yes not understanding that they were voting for a huge tax increase.

These new local levy property taxes came into place in 2019. As a result of the new local levy taxes, property taxes on millions of homeowners have increased by 60% over the past 6 years – something not shown at all on the chart above.

What is also not shown on the above chart is that $2.9 billion in federal COVID funds were added to school funding in 2020, 2021, 2022 and 2023. Therefore, actual school spending remained near $14 billion in 2020 -21 and 2021 -22. The decline in federal emergency funds began forcing school districts to make budget cuts in May 2023 and even more severe cuts in May 2024.

Finally, what is also not shown on the above chart is that projected school funding for the 2024-25 school year is expected to decline down to $12 billion – which is exactly where school funding was before the McCleary Levy fix was put in place. The only difference is that because teachers were falsely told by Reykdal and the Teachers Union that the McCleary fix “added two billion to school funding”, teachers demanded and were given 10% to 20% pay raises – which now that the truth has finally come out that there was no additional funding – will require 10% to 20% of the teachers to be fired (increasing class sizes and work loads 10% to 20%) in order to balance the budget for the coming school year.

The other thing not shown on the above chart is that school funding, adjusted for inflation, will continue to decline every year from this point forward due to some hidden provisions of the 2017 McCleary Fix. The chart above shows that school funding declined by more than a billion dollars during the past three years. School funding will continue to decline by another billion dollars during the next three years – and another three billion dollars during the following three years - requiring even more teachers to be fired and more schools to be closed EVERY YEAR from now on until parents, teachers and school board members finally rise up and demand that something be done about fixing the McCleary fix.

A “Make Up” Pay Raise for Teacher in 2018 & 2019

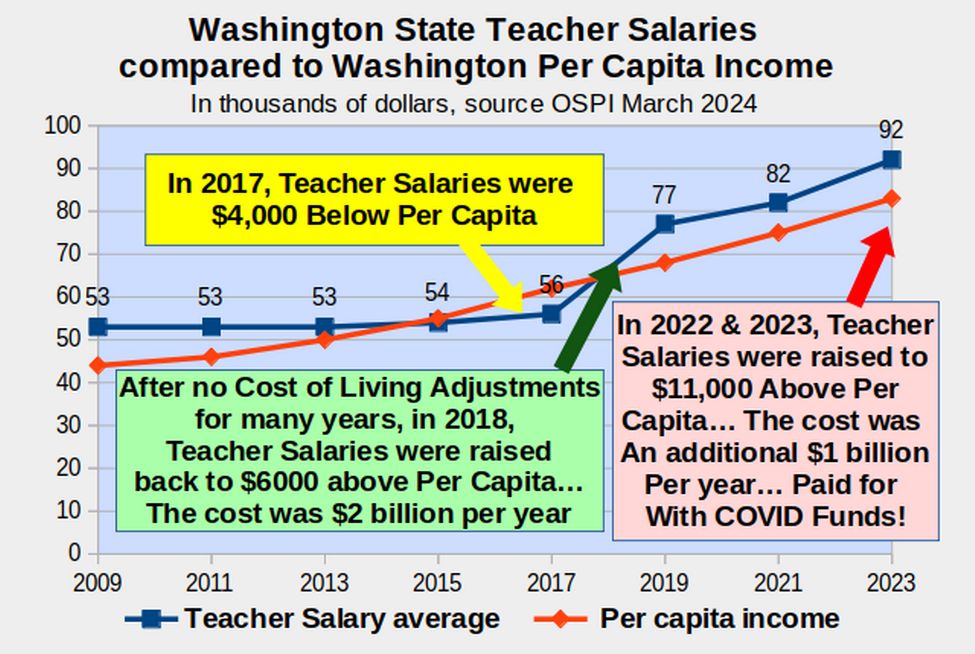

Teacher salaries historically have been about 10% above Washington Per Capita Income. 10% above Per Capita income is a good estimate of the average salary of people with advanced degrees.

In Washington State, the average teacher is required to have a Master’s Degree. Per Capita income in turn is about 10% above the median income because a few wealthy billionaires skew the result.

Sadly, beginning in 2003, the Washington State legislature began giving away billions of dollars in tax breaks to wealthy corporations like Microsoft and Boeing. These tax breaks for wealthy corporations are a violation of several sections of the Washington State Constitution. These billions of dollars in illegal tax breaks were paid for by failing to give teachers “Cost of Living” Pay Increases for many years. This failure over a period of several years, lowered the salary of teachers to $4,000 below the Per Capita income by 2017:

Source: Pages 17 and 18 Tables 1 and 2 in this link:

https://ospi.k12.wa.us/sites/default/files/2024-02/allpersonnelsummaryreport2023-24.pdf

Please note that the above table refers to the average teacher salary. The beginning teacher salary is about $12,000 per year less than the average salary and it takes about 5 years to reach the average salary.

This recognizes the fact that it takes about 5 years of experience for a teacher to become a truly effective teacher. At the same time, teachers with more than 10 years of experience are typically paid $12,000 above the average salary shown above.

In June 2017, the legislature passed the Levy Swipe Bill (House Bill 2242) which the legislature and Reykdal claimed would raise school funding by $2 billion – but the Levy Swipe did not actually increase school funding because it merely took $1 billion in Local Levy funds and called them State funds and took another $1 billion from local governments and called this State funds.

However, because 2018 was the “double taxation” year, with both the new high state levy and the old high local levies, there was temporarily $2 billion extra to bring teacher pay up to $6000 above the State Per Capita income in 2018 and 2019.

This return to $6000 above Per Capita income ended the McCleary lawsuit in 2018 – but led to monstrous tax increases - mainly in King and Snohomish counties. Now it was not teachers who were paying for the unconstitutional tax breaks to wealthy corporations – it was homeowners in King and Snohomish counties!

The cost was $2,000 to $3,000 per year in additional housing costs that were already far too high. Rents also went up dramatically as landlords passed on these property tax increases. So renters also paid for the Levy Swipe – which was therefore a factor that increased homelessness in King and Snohomish counties. But the real problem was that there was no actual increase in school funding other than Levy Swipe property tax scam.

As we noted earlier, in the summer of 2018, despite the fact that the additional $2 billion in school funding would only be available for a single year (2018 to 2019) due to the double taxation year, and there was no real long term increase in school funding, Reykdal boasted to teachers that there was lots of money and they should demand billions in dollars in pay raises.

Reykdal wrote in a July 26, 2018 memo and then repeatedly stated: “There is no cap on the size of pay raises that can be negotiated for certificated and classified staff this year.”

The Teachers Union betrayed their own members by repeating Reykdal’s Big Lie. On July 31, 2018, the Teachers Union posted an article stating: “Don’t accept excuses from your school board or superintendent – or anyone else. Thanks to McCleary, the money is there. $2 billion for classified and certificated pay raises – this year… $2 billion represents a 16-20 percent increase in state funding per school district.”

Legislators protested that the McCleary fix bill contained a cap on pay raises of 3.1 percent. Reykdal countered that since the McCleary fix bill eliminated the statewide teacher salary table (which paid teachers different amounts based on their years of experience), each school district was free to create their own salary table.

With Reykdal’s blessing and encouragement, the Teachers Union then used this misunderstanding to propose new Teacher Pay tables in every school district that were 10 to 20 percent higher than the prior statewide Teacher Pay Table. They then added 3.1 percent pay raises to the new Teacher Pay Tables for a total raise that far exceeded the intent of the legislature.

Here were the raises obtained in some of the larger school districts in August 2018: Shoreline 24 percent. Bremerton 20 percent. Edmonds 19, Bellevue 17 percent, Issaquah 15, Spokane 13 percent, Lake Washington 12 percent.

Sadly, most school board members believed the hype about the huge increase in school funding and failed to understand that there was no long term increase in school funding. Any pay increases they granted would eventually need to be paid for by firing staff. For example, on August 17, 2018, the Spokane School District agreed to a 13% pay raise. Two days later, on August 29, 2018, the Spokane School District published a 4 year budget with a deficit of $12.6 million for 2018-19, $40.5 million for 2019-20, $49.3 million in 2020-21 and $57.2 million in 2021-22. On April 11, 2019, the Spokane school district announced a shortfall for the 2019-20 school year of $31 million. To balance their budget they were forced to fire 325 employees including 182 teachers – due entirely to Reykdal’s lie to teachers that the money for pay raises was there – when in fact it was not.

How Federal Emergency Funds were used to hide the truth about the Levy Swipe

A new gimmick was needed to hide the Levy Swipe Crime in the 2020-21 school year. The illusion of school funding was continued by a temporary infusion of $4 billion in federal emergency COVID funds. The federal funds were divided into four installments - $1.4 billion in the 2020-21 school year, another $1.2 billion in 2021-2022 school year, another $800 million in the 2022-23 school year and the remaining $400 million in the 2023-2024 school year.

The gradual loss of the federal emergency funds forced school districts to make $200 million in cuts in May 2021 for the 2021-22 school year and $400 million in cuts in May 2022 for the 2022-23 school year. Another $400 million in cuts were needed in May 2023 for the 2023-24 school year and a final $400 million in cuts will be made in May 2024 for the 2024-25 school year. We summarize these cuts by school district later in this report. But the important point is that the 2024-25 school year will be the first year when the Levy Swipe budget cuts will become fully visible.

An Unwise and Unsustainable Raise in Teacher Pay in 2022 & 23

The truth about the Levy Swipe began to come out in the 2021-22 school year when COVID funding fell by $200 million to just $1.2 billion per year which forced school districts to make $200 million in cuts. In May 2022, school districts were hit by a Double Whammy. COVID funding fell by another $400 million to just $800 million per year. But to add insult to injury, the 2022 legislature passed a Teacher Cost of Living adjustment that was far above the increase in Per Capita income (look closely at the chart above to see this). This unwise pay increase cost school districts another $500 million and the combination of declining COVID funds and rising teacher pay, forced school districts to fire thousands of teachers – and thereby increasing class sizes.

In May 2023, another Double Whammy occurred with COVID funding falling another $400 million to $400 million and the 2023 legislature again passing a a Teacher Pay increase that was far above the Per Capita income (look closely at the chart above to see this).

This unwise pay increase cost school districts another $400 million. The combination of declining COVID funds and rising teacher pay, forced school districts to fire thousands of additional teachers – and thereby increase class sizes even more.

In May, 2024, federal COVID funds will drop another $400 million to ZERO. For the first time since 2017, school districts will finally be forced to deal with the reality of the Levy Swipe. They will therefore have to fire thousands of additional teachers and thereby increase class sizes even more.

I want to be clear here. I fully support paying teachers near 10% above Per Capita income. I also fully support paying teachers Cost of Living Increases as well as extra pay for the cost of living in a high cost area like King County. I am not proposing that teachers be forced to live in the back of their car. But requiring school districts to pay teachers 10% above the Per Capita income when there is no matching increase in state funds – which was the net effect of the 2022 and 2023 pay increases – simply leads to firing 10% of the teachers.

Simple math tells us that a 10% increase in teacher pay - with no long term increase in school funding - must lead to a 10% decline in the number of teachers and a 10% increase in class sizes (which are already among the highest in the nation). This is one of many reasons that thousands of teachers lost their jobs in 2023 and thousands more will lose their jobs in 2024.

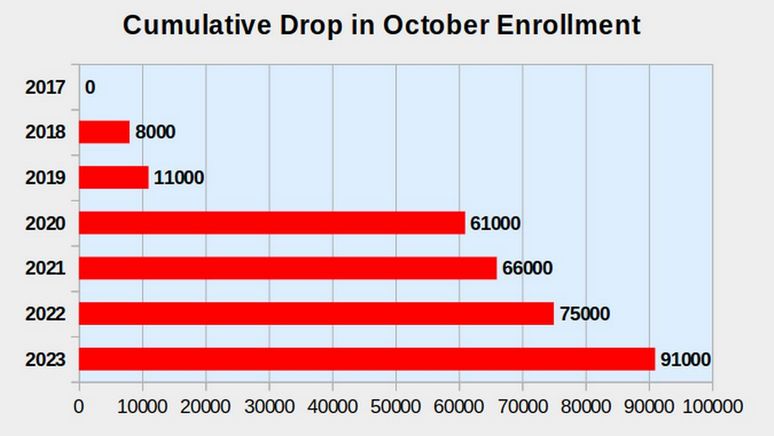

Reykdal’s radical policies led tens of thousands of parents to pull their kids out of our public schools

School districts have also lost huge numbers of students as parents pull their kids out of school because they were opposed to the Reykdal’s radical policies on racial shaming to schools hiding (kidnapping) children from their loving devoted parents. It hardly seems possible that a single politician could inflict so much harm on so many children in such a short period of time. Yet during the past 8 years that Chris Reykdal has been the Washington State Superintendent, a record 91,000 parents have pulled their kids out of our public schools:

In Snohomish County, enrollment is down 5,000 students from 2019-2020 to 2021-22. That’s a loss of $50 million. In Mukilteo, the district lost 630 students, or the equivalent of an entire elementary school. Puyallup lost 450 students. In addition, another 6 percent of students who were enrolled in October 2022 dropped out of school by the end of the year. This is another 64,000 students dropping out of our schools for a total of 155,000 decline in enrollment.

Of the kids remaining in our schools, the percent who are chronically absent has skyrocketed from 17% to 30% – with many school districts now over 40%. In total, more than 350,000 students are now chronically absent.

Massive Inflation during the Past Four Years

During the past four years, school districts have faced massive inflation in several areas. These include food, energy and insurance prices all of which have more than doubled during the past four years. These huge increases together with the huge decline in student enrollment has added a further $100 million per year burden on school districts which is why actual budget cuts in May 2023 and 2024 were over $500 million in 2023 and 2024 even though the loss in federal COVID funds was only $400 million in 2023 and 2024.

The Net Result is both High Property Taxes, Massive School Budget Cuts and Thousands of Teachers being fired

In May 2023, more than 50 school districts were forced to cut 500 million dollars and fire thousands of teachers and support staff. In May 2024, more than 100 school districts will be forced to cuts another 500 million dollars - firing thousands more teachers and support staff. The total cuts over the past two years will be more than one billion dollars.

Here is some of the announced cuts in many school district made in May 2023 and again in May 2024:

Seattle school district $105 million in May 2024 after making $100 million in cuts in May 2023. The result will be fewer schools (closing more than two dozen schools), fewer teachers and larger class sizes.

Vancouver school district cutting $35 million. 261 positions including 50 elementary teachers and 63 secondary teachers.

Evergreen School district cutting $20 million in May 2024 after cutting $20 million in May 2023. 140 staff will be cut including 20 elementary teachers and 50 secondary teachers.

Here is a table of school districts budget cuts in May 2023 & 2024:

|

School District |

Two year Budget Cut in Millions |

Two year estimate of Teachers Fired |

|

Seattle |

105 x 2 = $210 |

330 x 2 = 660 |

|

Everett |

38 x 2 = $76 |

130 x 2 = 260 |

|

Vancouver |

35 x 2 = $70 |

120 x 2 = 240 |

|

Kent |

31 x 2 = $62 |

115 x 2 = 230 |

|

Mukilteo |

25 x 2 = $50 |

75 x 2 = 150 |

|

Northshore |

21 x 2 = $42 |

63 x 2 = 126 |

|

Evergreen |

20 x 2 = $40 |

60 x 2 = 120 |

|

Bellingham |

16 x 2 = $32 |

48 x 2 = 96 |

|

Tacoma |

15 x 2 = $30 |

45 x 2 = 90 |

|

Lake Washington |

15 x 2 = $30 |

45 x 2 = 90 |

|

Puyallup |

14 x 2 = $28 |

42 x 2 = 84 |

|

Shoreline |

14 x 2 = $28 |

42 x 2 = 84 |

|

Edmonds |

12 x 2 = $24 |

36 x 2 = 72 |

|

Renton |

11 x 2 = $22 |

33 x 2 = 66 |

|

Issaquah |

11 x 2 = $22 |

33 x 2 = 66 |

|

Bellevue |

10 x 2 = $20 |

30 x 2 = 60 |

|

Olympia |

10 x 2 = $20 |

30 x 2 = 60 |

|

Highline |

8 x 2 = $16 |

24 x 2 = 48 |

|

Central Kitsap |

7 x 2 = $14 |

21 x 2 = 42 |

|

Camas |

6 x 2 = $12 |

18 x 2 = 36 |

|

Auburn |

4 x 2 = $8 |

12 x 2 = 24 |

|

Tumwater |

4 x 2 = $8 |

12 x 2 = 24 |

|

Bainbridge Island |

4 x 2 = $8 |

12 x 2 = 24 |

|

Snoqualmie Valley |

3 x 2 = $6 |

9 x 2 = 18 |

|

Woodland |

3 x 2 = $6 |

9 x 2 = 18 |

|

Washugal |

3 x 2 = $6 |

9 x 2 = 18 |

|

Lynden |

3 x 2 = $6 |

9 x 2 = 18 |

|

Blaine |

2 x 2 = $4 |

6 x 2 = 12 |

|

Longview |

2 x 2 = $4 |

6 x 2 = 12 |

|

North Kitsap |

2 x 2 = $4 |

6 x 2 = 12 |

|

Sequim |

2 x 2 = $4 |

6 x 2 = 12 |

|

Mount Baker |

1 x 2 = $2 |

3 x 2 = 6 |

|

TOTAL |

457 x 2 = $914 million |

1361 x 2 = 2742 teachers |

A record number of school districts are now on the verge of bankruptcy. Marysville, La Conner and Mount Baker are all facing bankruptcy. All three have been forced to borrow against future revenue. Marysville needed a $5 million loan just to get through the school year. Marysville is facing $17 million in cuts.

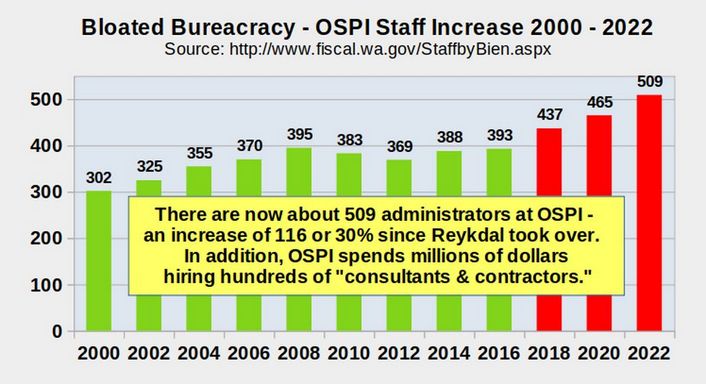

While Teachers are being fired by the thousands, Reykdal has added a record number of paper pushing bureaucrats in Olympia

While school funding has been going down in Washington state and thousands of teachers are being fired while our property taxes have been going through the roof, Reykdal has been adding more than one hundred paper pushing bureaucrats to his office in Olympia. https://fiscal.wa.gov/Staffing/StaffByBien

How do we fund our schools without placing a monstrous property tax burden on homeowners in King and Snohomish Counties?

The 2017 Levy Swipe illegally increased property taxes on homeowners in Snohomish County by just under $1 billion dollars per year and illegally increased property taxes on homeowners in King County by just under $2 billion per year. So we need to find $3 billion per year to replace the Levy Swipe funds. The most obvious place to get the first billion dollars a year is by repealing the illegal Microsoft Tax break.

The Levy Swipe scam was hatched by two of Bill Gates top assistants, Democrat Ross Hunter and Republican Chad Magendanz. The purpose of the Levy Swipe was to protect billions of dollars in illegal tax breaks for corporations like Microsoft that basically control Olympia.

The Microsoft Tax break lets Microsoft pretend they are located in Reno Nevada instead of Redmond Washington. So the real reason property taxes were jacked up on homeowners in King and Snohomish counties was to protect billions of dollars in tax breaks for the richest corporation in the history of the world.

Is there anyone who actually believes that a corporation worth THREE TRILLION dollars can not afford to pay their fair share of state taxes? Or that it is fair to shift the Microsoft tax burden to parents struggling to raise their families? The Microsoft tax break is only one of 700 tax breaks that rob the rest of us tax payers of more than $20 billion per year. All of these tax breaks violate several sections of our State Constitution.

Why Tax Breaks are Prohibited by our State Constitution

Throughout the State Constitution, there are several clauses that indicate that granting tax breaks to private corporations is unconstitutional. Here are just three of those clauses.

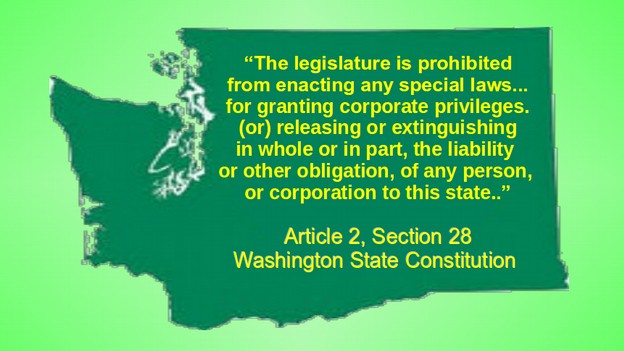

Article 2, SECTION 28 SPECIAL LEGISLATION. The legislature is prohibited from enacting any private or special laws... Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

Every tax break passed by the Washington legislature is a clear violation of Article 2, Section 28 of our State Constitution. Yet, despite Washington having the strongest prohibitions in the nation against corporate tax breaks, only New York and Louisiana grant tax breaks to wealthy corporations to a greater extent than the Washington legislature. Here are the five most corrupt states according to a recent national study: https://subsidytracker.goodjobsfirst.org/state-totals

Note that the actual value of state tax breaks and subsidies is much higher than the disclosed values. In Washington state, it is about double the disclosed value of $18 billion per year as many major tax breaks – including the billion dollar a year Microsoft Tax Break – are not even list in the Washington State tax exemption reports.

Even at $18 billion per year, Washington grants more in tax breaks every year than they spend on the education of one million children:

|

State |

Subsidies in millions of dollars per year |

Students in Millions |

Corporate Subsidies per Student per year |

Corruption Rank |

|

Louisiana |

$39,000 |

0.7 |

$55,714 |

1 |

|

New York |

$60,000 |

2.7 |

$22,222 |

2 |

|

Washington |

$18,000* |

1.1 |

$16,364 |

3 |

|

Michigan |

$23,000 |

1.5 |

$15,333 |

4 |

|

Texas |

$27,000 |

5.7 |

$3,737 |

35 |

|

National Average |

$357,000 |

52.1 |

$6,852 |

NA |

*The total amount of lost tax revenue these 700 exemptions account for is now more than $30 billion per year. In granting 700 tax exemptions, some of which apply to only a single corporation, such as Microsoft or Boeing, our state legislature has created laws that clearly violate the uniformity clause of Article 7, Section 1 of our State Constitution. These special tax breaks are not legal even if the Constitution did not have a Paramount Duty clause. But when we also consider the Paramount Duty clause and how hard the drafters of our State Constitution worked to prevent corporate corruption in our state, the existence of these 700 illegal tax breaks adds insult to injury.

Why Corporate Tax Breaks are a Crime Against our Children

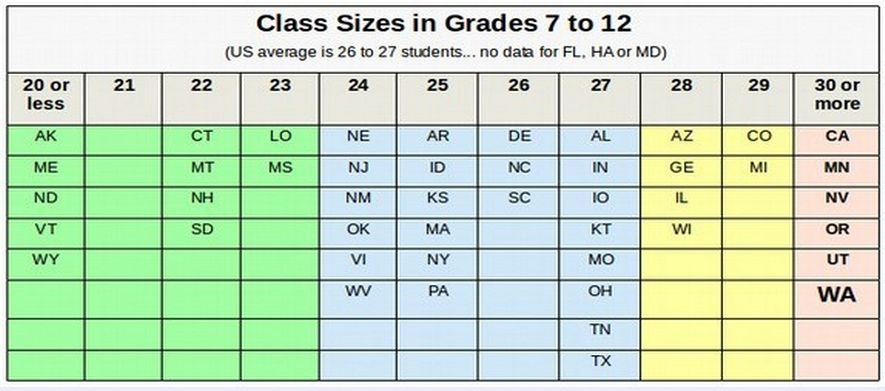

To pay for these corporate tax breaks, the legislature failed to provide school districts with the funds needed to hire more teachers to keep up with increasing enrollments. As a consequence, over time, class sizes in Washington state increased to among the highest in the nation.

As a consequence of having the highest number of corporate tax breaks in the nation, our kids were (and still are) forced to deal with the highest class sizes in the nation. In 2011, the average class size in Washington state was nearly 30 students. Here is a distribution of class sizes showing which states have low, average, above average or extremely high class sizes: https://nces.ed.gov/programs/digest/d13/tables/dt13_209.30.asp

The problem with high class sizes is that struggling students do not get the help they need and teachers suffer from nervous breakdowns:

The Solution to the School Funding and Property Tax Crisis

The 2017 Levy Swipe plan was adopted to protect 700 illegal corporate tax breaks totaling more than $20 billion. All of these tax breaks are contrary to several sections of our state constitution. But merely repealing a small fraction of these tax breaks would allow us to roll back property taxes to what they were before the levy swipe – saving homeowners thousands of dollars a year in property taxes. Repealing even a few of these illegal tax breaks would also allow us to increase school funding by $1 to $2 billion a year – allowing us to rehire the thousands of teachers who were fired due to the loss of a billion dollars in federal funding. This proposal to increase school funding by one to two billion dollars a year must include a clear provision that never again would school districts be allowed to use one time emergency funds to raise teacher pay. Teacher pay increases must be offset by equal reductions in corporate tax breaks.

Why we need to build a Parents Network here in Washington State

It should be obvious that we can not count on the legislature to fund our schools when corrupt legislators are having their re-election campaigns paid for by the corporations getting billions in state tax breaks. It is also pointless to attend school board meetings when school boards are required to have a balanced budget. So, schools will continue to be closed and teachers will continue to be fired until we parents can form a large enough political movement to win some elections – which is the point of this website! So the first step is to sign up for our newsletter list. The second step is to share this website with other concerned parents & grandparents.

The third step is to share this website with your local school board members. Eventually our goal is to organize parents and school board members in every school district in Washington state – and then create our own Statewide Commission to solve the school funding crisis.

A New Statewide Commission to Solve a Very Old Problem

Over the past 30 years, there have been more than a dozen commissions which attempted to solve the education funding problem in Washington state. Each of these commissions involved members of the state legislature and each of these commissions failed miserably. After the disaster of the 2017 Levy Swipe Act, it should be obvious that our State legislature is simply not capable of solving this problem. I therefore propose a completely different kind of School Funding Commission – a commission made up of experienced school board members who are experts about the actual needs of school districts.

To keep discussions efficient, I propose a commission of 15 experienced school board members from school districts around the state. Each of the 15 should have at least 4 years of experience in setting school budgets and each should be willing and able to volunteer a significant amount of time. Ideally, there should be one member from each of the four largest school districts, Seattle, Lake Washington, Spokane and Tacoma. In addition to two members from King County, and one member from Pierce and Spokane county, there should be one member from the other eleven largest counties including Snohomish, Thurston, Clark, Kitsap, Yakima, Whatcom, Benton and Skagit counties. Commission assignments would be approved by school board members in each county and each member would serve for one year. It is understood that members would miss some meetings due to their ongoing local school board meetings. The Commission would be chaired by a school board member elected from the group of 15. During the year, the Commission would hold at least one in-person meeting in each of the 15 largest counties to accept written and verbal testimony from any school board members, parents and teachers in those counties. In addition, the Commission will hold online meetings in the remaining 24 counties to accept verbal and written comments from citizens in each of those counties. In addition, there will be a web portal to accept additional comments from citizens across Washington state.

The goal of the Commission will be to create an Initiative to the Voters to restore school funding in Washington State to a level that is at least above the national average school funding and reduce class sizes until they are at least at or below the national average. This plan should also include a pathway for repealing illegal corporate tax breaks.

The plan website should also provide voters with a list of State Representatives and Senators and candidates for these offices who support the plan, who oppose the plan and or who have not taken a position on the plan so that parents and other concerned citizens who are in favor of restoring at least national average school funding will know who to vote for in coming elections. It will be up to us parents, grandparents, teachers and school board members to gather the signatures for the Initiative to put in on the ballot.

As always, I look forward to your questions and comments – and I look forward to meeting you!

Regards,

David Spring M. Ed.

David at Washington Parents Network dot com