Last week, I posted an article exposing Reykdal’s plan to further increase property taxes on homeowners across Washington State by increasing the Levy Lid. The Levy Lid acts as a “cap” on how much any school district can charge local homeowners over and above the one percent property tax that homeowners pay to the state. I explained that Reykdal’s plan was in violation of Article IX Section 2 of the Washington State Constitution which requires the state to provide for a “uniform system of public schools” (as opposed to a system of rich schools in high property districts like Seattle versus poor schools in low property districts like Yakima).

I noted that in 1980, the Washington Supreme Court defined the word “uniform” to mean “a variance of no more than 10%”. Thus, the legislature in 1980 placed a Levy Lid of 10% on local school levies. This meant that Local Levies could not be more than 10% of the combination of State and Federal funding. So if the school district got $93 million in state funds and $7 million in federal funds, the school district could not ask for more than $10 million from local homeowners (10% of $100 million).

Sadly, over time, the state gradually and illegally transferred its Constitutional obligation to fully fund schools onto the backs of local homeowners – by gradually increasing the levy lid to 15%, then 20% and eventually 30% which was actually 40% due to “ghost” accounting tricks which I described in my last article.

This illegal transfer of school funding to local homeowners led to the McCleary lawsuit in 2004. In 2017, Reykdal and the legislature came up with a scam of stealing a billion dollars in local levy funds in King County and transfering these funds to the state general budget. At the same time, they lowered the local levy rate by a billion dollars in school districts like Seattle down to 15% - which while still against the Washington State Constitution, was at least lower than the grotesque 40% local levy rate that existed before the McCleary lawsuit. As I explained in detail in my last article, they used this magical accounting trick of subtracting one billion in local levy funds and adding one billion in state levy funds to falsely claim that they had increased state funding.

What Reykdal wants to do is keep the high State levy rate while at the same time restoring the blatantly unconstitutional 40% local levy rate. This would in fact raise one to two billion dollars in additional school funding. But it would do it in a blatantly unconstitutional manner by driving up property taxes on local homeowners – at a time when the McCleary school funding mess has already driven up local property taxes in King County by more than 70% during the past 7 years.

In response to my article, one of our members emailed me the following question: “There are two propositions on the ballot in Seattle to replace expiring levies for schools. Will this money go to Seattle schools or will it be redirected as you assert in your article?”

In this article, and because homeowners in Seattle have already gotten their levy ballots and must turn them in shortly, I will answer this question as it applies to the Seattle School District so that homeowners in Seattle can decide for themselves how to vote based on the actual facts rather than based on propaganda coming from the school district or from Olympia. But this information does apply to nearly every school district in the state and every school levy on the ballot in 2025.

Will levy funds you approve stay in your school district?

The answer is maybe yes or maybe no. In my opinion, a vote of the people is like a sacred contract. If voters are told that the funds will remain in the school district, in order to convince voters to vote Yes on the levy, then the funds should remain in the school district. However, it is a fact that in 2017, the legislature robbed homeowners in Seattle of millions of dollars in local levy funds and spread this money around the state. Voters in Seattle were then required to pass new levies – essentially a form of double taxation blackmail – to restore their local school funding. If the legislature did it before, they can certainly do it again. Especially since the legislature is currently spending money like a bunch of out-of-control drunken sailors!

A more important question is whether the two levies comply with the Washington State Constitution?

The answer is clearly NO. Both levies clearly violate the Washington State Constitution (which is supposed to be the highest law here in Washington state but is routinely ignored by nearly all of our elected officials.

The two levies consist of:

Levy #1 is an Operating budget levy of $747 million over three years. This is $249 million per year charged at a Levy rate of 78 cents per $1,000 of assessed value in 2026.

Levy #2 is a so-called “Capital Levy of $1.8 billion over 6 years.

This is $300 million per year. (Capital Projects: $1,385,022,403 plus Technology: $$414,977,597) charged at a Levy rate of 93 cents per $1,000 of assessed property value in 2026

The total cost of both levies is $1.71 per $1,000 of assessed property value in 2026. As of January 2025, the median home price in Seattle was $825,000, which is a 7% increase from the previous year. Therefore, the state property tax on the average Seattle home is 1% or $8,250 per year. This is money that is supposed to go to funding the schools. But because the legislature puts this money in their “General Fund” they can spend it on whatever they want.

So the school district is forced to ask local homeowners to kick in even more funding in the form of these two “excess” school levies (1.71 x $825 = $1411). The total property tax for the average homeowner in Seattle is $9,661 plus whatever excess levies are approved by the voters such as Parks or the Fire Department. I moved out of King County to escape this insanity. But if you live in Seattle or anywhere in King County, feel free to email me with your actual home value and actual property taxes. It would be nice to know how much each of us are being robbed.

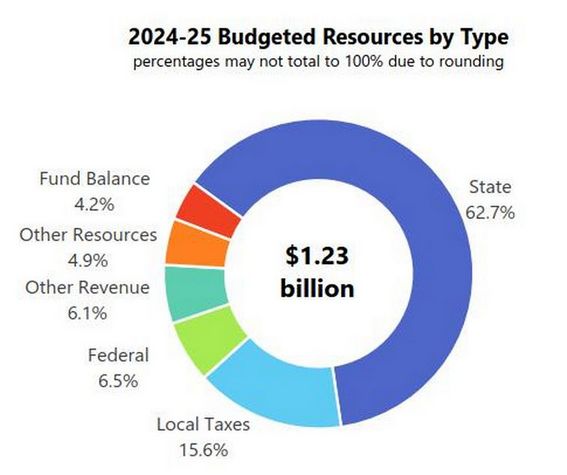

Below is a chart of the current Seattle School District Operating budget:

The state provides Seattle Public Schools with 62.7% of the $1.23 billion.

https://www.seattleschools.org/wp-content/uploads/2024/06/Recommended-Budget-Book-2024-25.pdf

See page 7

More to the point, the current levy amount is 15.6% of the $1.23 billion budget. Thus, the current levy is only $191 million per year.

The new local levy will be $249 million per year which is 20% of the current total Operating budget! But the correct ratio is to first determine the budget without the local levy and then determine the percent of the levy compared to non-levy funding. So $1.23 billion minus $249 million local levy is $981 million in non-levy funding. $249 million divided by $981 million is 25%. Since 25% is clearly greater than the Constitutional maximum of 10%, the Operating portion of the two levies is about $150 million above the Constitutional limit.

But it gets worse. Much worse. Because the real Seattle School District budget also includes the fake “capital budget” which is simply another way to scam the voters with accounting tricks. In fact, buying computers and fixing the plumbing should be part of the operating budget (because the real capital budget is for building schools not for operating schools). So the correct math is to first determine the non-levy budget which again is $981 million. Then add $249 million plus $300 million in the scam and completely unconstitutional capital levy and you get a real total local levy of $549 million per year. $549 million divided by $981 million is 56% which is five times more than the 10% Constitutional limit. Seattle homeowners will be paying $449 million more than they should pay if either the Washington State legislature or the Seattle School Board actually complied with Article 9, Section 2 of our State Constitution.

But if the legislature adopts the Reykdal school funding scam this Spring (and it is almost certain that they will), things will get even worse. There will be a new Operating Budget levy in 2026 blackmailing local homeowners into approving a doubling of the levy rate from the current 15% (really 20%) to 30% (really 40%).

This will add another $249 million onto the backs of local homeowners for a total of $549 million plus $249 million equals $800 million – which is $700 million more than the Constitution 10% limit.

But what about the Seattle School District $150 million shortfall?

In my opinion, it does not matter how many levies you pass, as long as the crooks remain in power, there will still be a $150 million budget shortfall. The problem is not too little funding. It is too much waste.

As I explained in the last article, the shortfall is due entirely to the legislature continuing to give billions of dollars in unconstitutional tax breaks to corporations like Microsoft and Boeing. Microsoft alone gets a tax break of more than a billion dollars a year just by pretending they are located in Reno Nevada rather than Redmond Washington. Microsoft makes hundreds of millions of dollars every year with their server farm in Quincy, Washington. Microsoft is worth $4 TRILLION dollars. Is there even a single person in our state who thinks it would harm Microsoft even slightly to pay their fair share of taxes for our schools?

Throughout the State Constitution, there are several clauses clearly stating that granting tax breaks to private corporations is unconstitutional:

Article 2, SECTION 28 SPECIAL LEGISLATION. The legislature is prohibited from enacting any private or special laws... Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

Every tax break passed by the Washington legislature is a clear violation of Article 2, Section 28 of our State Constitution. Yet, despite Washington having the strongest prohibitions in the nation against corporate tax breaks, only New York and Louisiana grant tax breaks to wealthy corporations to a greater extent than the Washington legislature.

Here are the five most corrupt states according to a recent national study: https://subsidytracker.goodjobsfirst.org/state-totals

Note that the actual value of state tax breaks and subsidies is much higher than the disclosed values. In Washington state, it is about double the disclosed value of $18 billion per year as many major tax breaks – including the billion dollar a year Microsoft Tax Break – are not even list in the Washington State tax exemption reports.

Vote to raise your property taxes or vote to support our State Constitution?

The Seattle School District is not alone in robbing local homeowners through illegally huge levies. Here are some websites that keep track of illegal levies all around Washington state. All school district tax measures for this current February 11th 2025 election are analyzed at this link:

https://schooldataproject.com/report_levies_20250211

The total is about $4 billion on the ballot this year.

Here are a couple of other companion websites that provide more reasons to vote no:

In my opinion, the solution to our state’s out of control spending problem is not to vote Yes on these levies. This only rewards illegal behavior in Olympia and in local school boards. When we close our eyes and allow illegal actions to occur, we become accomplices to this crime.

Instead, the solution is to vote No on the levies and then run for the school board or the legislature on a platform of restoring our Washington State Constitution by funding a uniform system of schools (Article 9, Section 2) with a uniform system of taxes (Article 7, Section 1).

Instead of raising property taxes homeowners by thousands of dollars each year, we ought to be requring the richest corporations in the history of the world (aka Microsoft) to pay their fair share of state taxes - like every other business and homeowner in Washington state – and in accordance with Article 7, Section 1 and Article 2, Section 28 of our state constitution .

If we merely complied with our State Constitution, there would be no need to put local levies on the ballot that exceed the 10% Levy Limit and are therefore clearly unconstitutional.

We will be discussing all of the crimes currently going on in Olympia at our next Washington Parents Network meeting this Sunday, February 2nd from 4 to 5 pm. If you would like the link to our video conference meeting, send me an email and I will reply with the link.

As always, I look forward to your questions and comments.

Regards,

David Spring M. Ed.

Addendum: One of our members emailed me the following additional reasons to consider voting NO on this year's Levies.

Please Vote No on Proposition 7 and 8

Prop 7 and 8 are supplemental school funding measures that ask all district households to give more than the state has allocated to Evergreen Public Schools. Outlined below are some of the many reasons why not giving more to Evergreen would end the self serving interests of its benefactors.

- The supplemental money is not primarily for education, but to enhance Teacher and Ancillary staff pay.

o It’s a fact that Evergreens certified staff (teachers) make an average of $125,000 per year. They only work three quarters of the year and have a benefits package that is executive level. Years of poor academic performance do not justify this level of pay.

- Low test scores and past performance do not justify spending more money. From the Washington State Report Card (OSPI test score results): o 38.8% of Students do not pass English Language Arts

o 46.9% of Students do not pass Math

o 41% of Students do not pass Science

o 77.6% of the Teachers have a master’s degree or higher

o Teachers on average have 15.2 years of experience

o Only 61.8% of the students attend 90% of the time, (vs. Camas 83.4%)

o $18,337 is spent on each student per year, (vs. Camas $16,959)

- The money is not for education alone but many non-educational items.

o Cyber security- will not enhance student performance.

o Multilingual learning-a statewide issue to be addressed by the legislature.

o Parent Square communication services- a duplication of standard email services

o Professional development- teachers are already compensated in salaries

o Security staff- cameras and monitoring devices already abound throughout the district buildings.

o Student and staff electronic devices- loss of fine motor skills and the ability to search, analyze, and report in a genuine format.

o Online curriculum- sadly in a district where only 60% attend 90% of the time, this has only amplified the problem.

o Network infrastructure, internet services, internet safety- can we justify the cost and benefit structure?

How much will the Levies cost YOU! For a homeowner with a $500,000 home:

$5095 over 4 years, or $1274 per year, or $106 per month

© P.Kronebusch Jan 2025