Each January since his 2020 unconstitutional school closures, Washington Superintendent, Chris Reykdal, has engaged in an annual contest to see if he can mislead the public more in a single hour than he did the previous year. This years contest occurred on January 16 2025. You can watch it on TVW if you want. I prefer to download the text version of his speech so I can take a few breaks to calm down periodically. Reykdal did make one accurate statement. At the end of his presentation, he said “We're living in the most unprecedented time of mis and disinformation.”

As we explain in this article, Reykdal is clearly an expert on disinformation.

Reykdal began his presentation by saying his talk would focus on increasing school funding. Despite the fact that the legislature has already overspent existing tax revenue by $4 billion to $10 billion, Reykdal had the audacity to ask for another $3 billion. Naturally, despite several questions from reporters, Reykdal refused to say where this extra $3 to $10 billion should come from. Maybe each school can hold a cake sale.

In this article, we will focus on the one area where Reykdal gave a specific recommendation to increase school funding. He wants to “lift the levy lid” to allow wealthy school districts, which are located mainly in King County, to raise property taxes – further increasing the tax burden on families in King County – families that have already seen their property taxes doubled thanks to Reykdal and his support for the McCleary School Funding Mess.

Here are a couple of quotes from his speech starting at 42 minutes: “the solution is to give them (wealthy school districts) the authority that they had, again, not unlimited, get them back to a percentage of their budgets. We were at about 28, 29% of budgets being levy before.The legislature cut that down to something like 15 or 16% on average.”

An Example of Driving Homeowners out of their Homes

Put in plain English, prior to passing the McCleary Mess in 2017, wealthy school districts in King County were allowed to charge homeowners an additional 30% of State School Funding on top of the amount provided to the school district by the State. So if the State gave a school district $100 million, the school district could blackmail the voters for an additional $30 million. If the voters failed to pass the property tax increase, then a pile of teachers would be fired.

Over time, the legislature found even more creative ways to pass the school funding tax burden on to local homeowners. For example, in 2003, the legislature gave an unconstitutional $200 million tax break to Boeing. To pay for the tax break, a week later, they gutted $200 million in school funding. But at the same time, they created the concept called “Ghost Funding” which is the funding that school districts would have had if the legislature had not gutted their funding. The levy lid became 30% of the Ghost Funding and not 30% of the actual funding.

For example, if your school district was supposed to get $100 million but actually only got $90 million (because the other $10 million went to Microsoft and Boeing), the school district could still blackmail local homeowners (aka the Local Levy) for 30% of what they “should have got” rather than 30% of what they actually got. So the Levy would still be for $30 million.

Over a period of years, so much was added to the ghost funding formula that 30% of imaginary ghost funding was 40% of actual funding. So what Reykdal really wants to do is return to the good old days of blackmailing the local homeowners in order to pay for billions of dollars in annual tax breaks for Microsoft, Amazon, Boeing and the other corporations represented by the lobbyists who paid for his re-election campaign.

The Reykdal McCleary Levy Swipe on Steriods

What Reykdal is really proposing is actually much worse than the robbery from the good old days. To understand the pure evil in his proposal, we need to review where the McCleary school funding increase actually came from. The people who wrote the bill called it a “Levy Swap”. I called it a “Levy Swipe”. Basically, Reykdal and his accomplices in Olympia took about $1 billion in local levy funds from school districts in King and Snohomish counties and deposited the $1 billion in the State General budget. They then called this a $1 billion increase in school funding when there was really no increase at all.

To compensate for stealing a billion dollars in local property taxes, they lowered the Levy Lid from 30 or 40% down to 15 to 20%. They did not do this to help local homeowners. They did this because if they did not do this, homeowners in King and Snohomish Counties would have seen an immediate 20% increase in their local property taxes due to having both high local property taxes and high state property taxes. This “double whammy” would have led to a tax payer revolt.

The legislature wanted to hide the tax increase so that it would occur gradually rather than immediately.

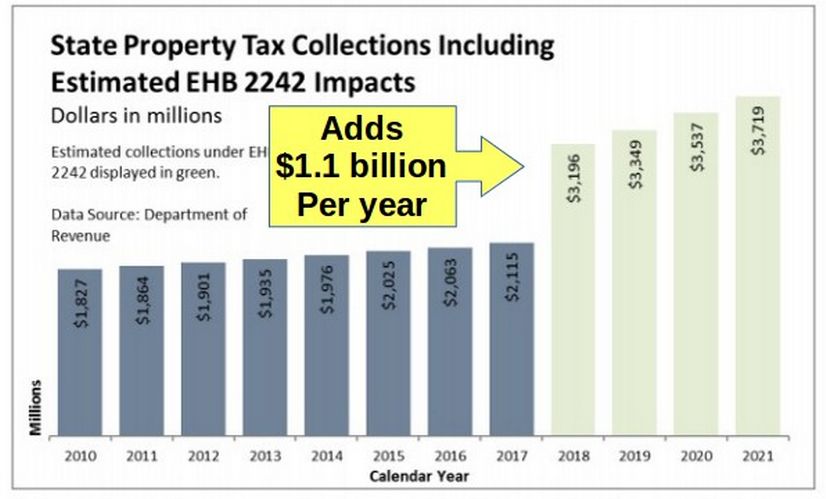

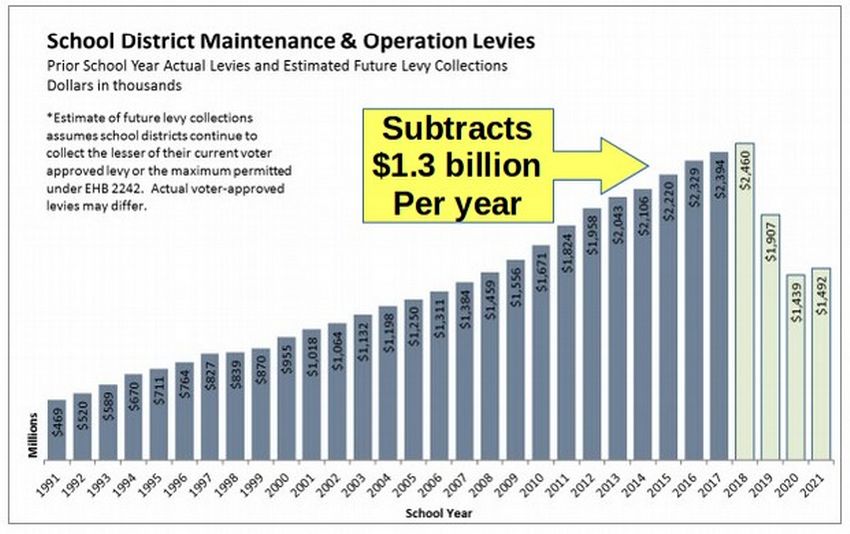

To be clear, $3.2 billion in 2018 minus $2.1 billion in 2017 equals $1.1 billion dollars. So new State funding would be $1.1 billion (or as we say throughout this report, about one billion dollars per year). But then a different State Chart on Page 57 of their Report shows local levies going from $2.7 billion in 2020 to $1.4 billion in 2020 – a loss in local levy funds of $1.3 billion dollars per year.

Notice that both state and local property taxes were high in 2018.

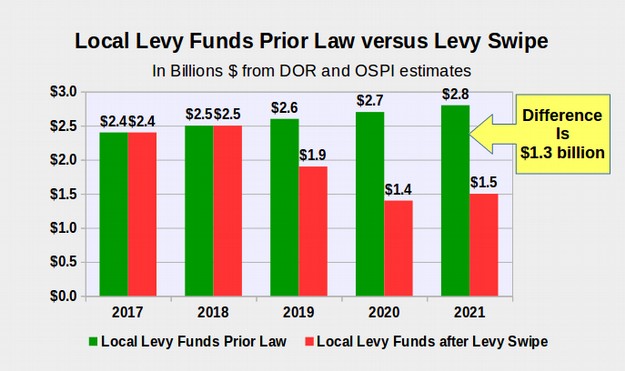

The 2017 local levies totaled $2.4 billion and had been rising at a rate of $100 million per year. This means that by the year 2020, under the former school funding model, local levies would have been $2.7 billion. Instead, local levies are estimated to drop by $1.3 billion (from $2.7 billion to $1.4 billion). Here is a chart that more clearly shows this year by year difference in local levy funds:

Thus, even according to the State’s own estimates in their report to the Supreme Court, the levy swipe resulted in a State gain of $1.1 billion but also a local loss of $1.3 billion for a NET LOSS OF $200 million per year beginning in 2020.

There was a huge school funding increase in 2018 to 2019. But it was not because of the McCleary Mess. Instead, it was because the legislature creating a “double taxation” year whereby the old tax system was left in place for one year at the same time the new high state property tax system was put in place. This double taxation year led to a temporary increase in school revenue of about $1 billion – all of which went to increasing teacher salaries.

Once the double taxation year was over, school districts would have faced massive budget cuts in the 2020 – 2021 school year. But wonder of wonders, the Federal government kicked in billions of dollars in Corona Virus funding. This hide the McCleary School funding mess for a couple of years. But in 2024, the federal Corona money went away and now teachers will be fired by the thousands of something is not done to fix this problem.

Instead of dealing with the real problem, which is billions of dollars in illegal tax breaks to some of the wealthiest corporation in the history of the world, Reykdal and his accomplices want to once again pass the school funding burden back on the shoulders of local homeowners.

Only this time, instead of having high “double” property taxes for a single year, meaning high local property taxes and high state property taxes at the same time, the “double” property tax burden will become permanent.

Reykdal is correct. Some wealthy school districts will pass local levies amounting to millions of dollars. But expect property taxes in King and Snohomish counties to skyrocket even more than they have in the past 7 years. Property taxes have already nearly doubled. Expect them to double again – costing homeowners thousands of additional dollars each year in increased property taxes. This is blackmail pure and simple.

Reykdal’s School Funding Scam violates several sections of the Washington State Constitution

Article 9, Section 2 of the Washington State Constitution requires a “uniform system of public schools.”

This provision was placed in our state constitution in order to avoid having a system of rich schools that could pass local levies and poor school districts that could not pass local levies. The 1977 Seattle 1 School Funding Decision (also called the Doran Decision) made it clear that local levies could not be used to fund our schools. See Seattle School District No. 1 v. State, 90 Wn.2d 476, 585 P.2d 71. Here is a link: https://law.justia.com/cases/washington/supreme-court/1978/44845-1.html

The Doran Decision required the State to fund schools rather than local homeowners. In response to the Doran Decision, the Legislature passed the Levy Lid Act which capped local levies at 10% of State School funding. The Washington Supreme Court agreed that a 10% cap complied with the “uniformity” provision of our State Constitution. For about 10 years, the Legislature complied. Sadly, in the 1990’s, the legislature began raising the Levy Lid and improperly transferring the burden for school funding from the State to local homeowners.

The Levy Lid was eventually raised to 30% and with the ghost funding accounting trick, it was raised to 40%.

A 40% cap means that there was and will once again be a 40% difference in funding between rich school districts and poor school districts.

To be clear, the maximum difference that meets the “uniformity” provision of Article 9, Section 2 of our state constitution is 10 percent. Reykdal and the legislature are likely to violate this provision either this year – or allow a school funding nightmare occur in May 2025 and then pass this insane unconstitutional provision in the 2026 session.

Billions of dollars in Higher Property Taxes will not be used to keep more schools open

Reykdal claimed during his presentation that the reason the Seattle School District should be allowed to drive property taxes through the roof is so they can avoid closing their small local schools. Here is a quote from Reykdal starting at the 16 minute mark referring to his plan to roll back the Levy Lid to the Pre-McCleary 40% level:

“Community like Seattle had the opportunity to tax themselves through property taxes for local levy to do things that are very important to them…The people of the Seattle school district for decades said we want more neighborhood schools that are smaller… So they were able to levy themselves additional resources to fund a lot of schools. That significant opportunity was cut dramatically by the legislature six years ago. Seattle and other communities in the state deserve that opportunity back.”

What Reykdal is referring to is the insane plan by the Seattle School Board in May 2024 to close 21 small local elementary schools – forcing thousands of elementary school students to attend schools much farther from their home. The Seattle School Board has been lying to parents about this plan and about the financial impact of closing schools.

The reason given for these 21 school closures is that the Seattle School District is facing a budget shortfall of over $100 million – a shortfall which is likely to rise to $130 million in May 2025 and over $150 million in May 2026. Closing a school results in a savings of about $1 million. Thus, closing 21 schools would still result in a budget shortfall of $80 million – rising to more than $100 million this year.

Reykdal is lying to the voters in the Seattle School District by claiming that if they only raise the Levy Lid back to 40%, they can keep their local elementary schools. The fact is that keeping their 21 local elementary schools is only $21 million of a Seattle School District budget shortfall that will soon be $150 million.

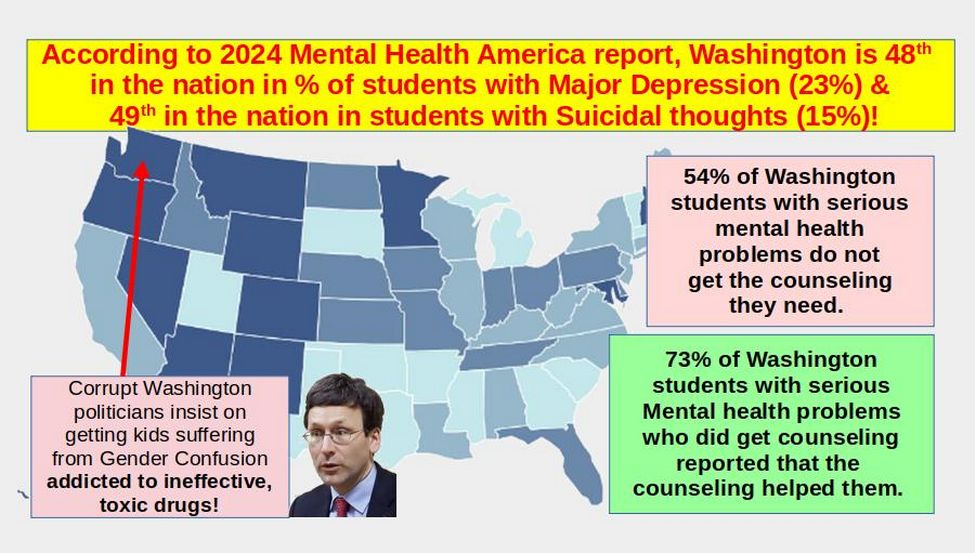

The real cause of the Seattle School District budget shortfall is skyrocketing Special Ed costs of more than $100 million due almost entirely to the fact that the mental health of students in the Seattle School District is among the worst in the nation – which in turn is due to the fact that the Seattle School District leads the nation in WOKE policies such as:

* Encouraging kids to start taking Trans Drugs

* Allowing boys in the girls bathroom.

* Allowing boys to take over girls sports.

* CRT and DIE propaganda beginning in Kindergarten.

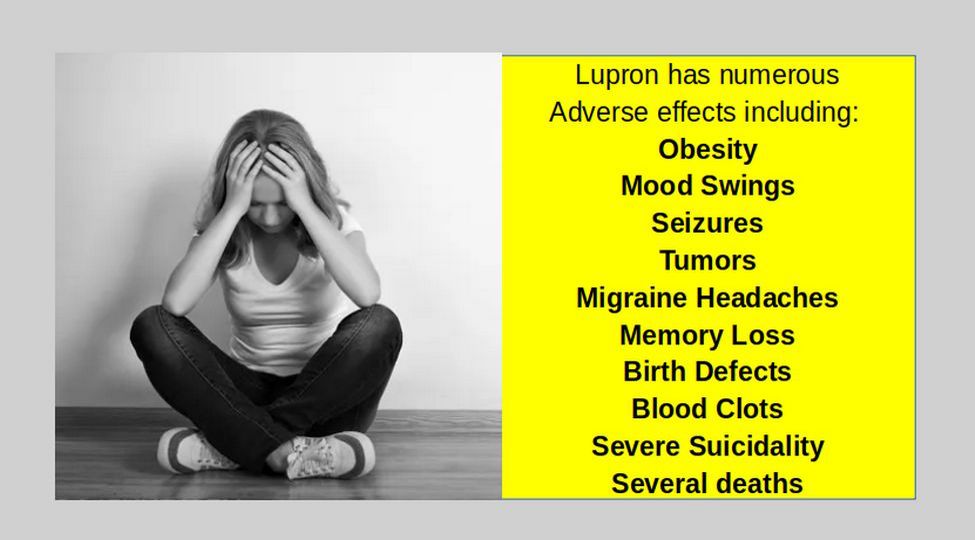

* Placing Drug dispensing “School Based Health Clinics” in dozens of schools. These so-called Health Clinics are giving puberty blockers to thousands of kids in the Seattle School District without the knowledge or consent of their parents – despite the fact that puberty blockers such as Lupron are known to cause serious mental health problems:

* Thousands of students who are currently lying to their parents about what name they are called in school while Seattle parents are kept in the dark thanks to Reykdal blocking and ignoring the Parents Rights Initiative.

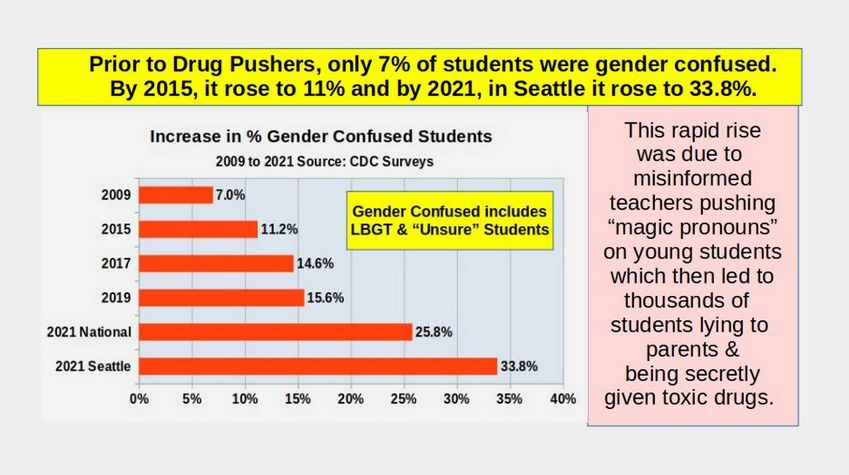

A recent survey of students in the Seattle School District found that one third of the students were not able to tell if they were a boy or a girl. Of the Seattle School District high school students who completed the 2021 CDC survey, 34% were Gender Confused. In short, nearly one in three Seattle High School students now claim to be LBGTX.

All of this has resulting in Seattle Students having the worst mental health and the highest fentanyl drug overdose rates in the nation.

One of the key provisions of the Parents Rights Initiative is that school districts would be required to tell parents about children who were being given gender transition treatments without the parents consent. Had Reykdal not issued his last minute block of the Parents Rights Initiative, at least some of the current gender mutilation cases occurring at school based health centers might have been exposed.

If parents in Seattle ever learned the truth about the harm being inflicted on their kids by Chris Reykdal and Bob Ferguson, we would see an entirely different and more sane group of legislators elected in Olympia. But instead all Seattle voters get are more lies from Reykdal that they can keep their elementary schools open if they allow property taxes to go through the roof. All higher property taxes will do is lead to more funding for Seattle School District WOKE insanity.

The only solution to skyrocketing property taxes is to start Common Sense Community News websites

This is one more of many reasons to start Common Sense Community News websites. We need to let homeowners know that they do not have to choose between skyrocketing property taxes versus closing hundreds of schools and firing teachers by the thousands. Instead, what we really need to do is boot Reykdal and his accomplices out of office and replace them with Common Sense candidates who will honor our State Constitution, lower property taxes by restoring the 10% levy lid and fund the schools by requiring wealthy corporations like Microsoft and Boeing to pay their fair share of state taxes – just like every other business in Washington state.

As always, I look forward to your questions and comments. Please note that there will be no Washington Parents Network meeting this Sunday January 26th. However, we will be discussing how to stop the dramatic increase in property taxes at our next meeting on Sunday February 2, 2025. If you would like the link to that meeting, send me an email and I will add you to our list.

Regards,

David Spring M. Ed.

Washington Parents Network

david@washingtonparentsnetwork (dot) com